Biden’s Payroll Tax Hike Strategy: Outside of the Donut Hole

Table of Contents

What You Want to Know

- Biden’s approach to impose payroll taxes on significant earners would generate a

- Substantial-earning consumers could possibly be capable to offset, defer or reclassify profits to steer clear of the more tax.

- Although there has been minimal chat about this approach recently, lawmakers are properly mindful that the Social Stability and Medicare trust resources have shortfalls that want to be dealt with.

If you stroll via the streets of Chicago, you have very likely heard from the locals and longtime transplants about the well-known Stan’s Donuts & Coffee on North Damen Avenue. Nevertheless skeptical and deviant from my preferred desserts, I ought to profess — the donuts stay up to their hype.

But there is yet another, significantly much less savory donut — or at least a donut gap — that has anyone speaking: President Joe Biden’s program to impose payroll taxes on earnings above $400,000, developing a “hole” concerning that figure and the latest ceiling of $142,800 in taxed wages.

Payroll Tax Prices

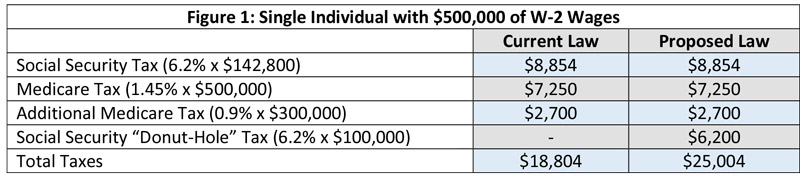

For wage earners, Social Safety and Medicare taxes — collectively recognized as payroll taxes — equal 6.2% and 1.45%, respectively, and are instantly withheld from paychecks by businesses underneath the “pay as you go” tax method. Take note that for 2021, Social Safety taxes are only used up to $142,800 in earnings, but Medicare taxes have no revenue limitation.

In addition, there is an “Added Medicare Tax” of .9% that applies to earnings exceeding $200,000 (one) and $250,000 (married submitting jointly) of adjusted gross money (AGI). Besides for the Extra Medicare Tax, companies spend an equal share of these taxes on the wage earners’ income but can deduct these taxes on their tax returns.

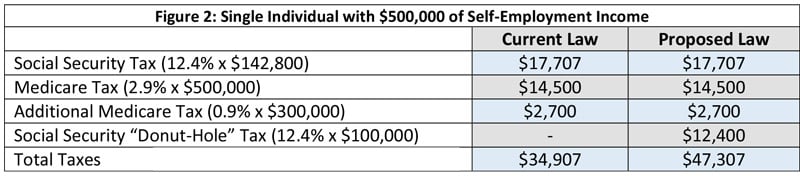

In the meantime, self-used persons, who act as each an employer and employee, are accountable for spending both of those shares of these taxes via quarterly payments. Referred to as self-work taxes, the Social Security tax equals 12.4% of up to $142,800 in 2021 earnings, whilst the Medicare part equals 2.9% without limit.

Self-utilized men and women also confront the Extra Medicare Tax, but the price stays at .9% because it only applies to the personnel portion of earnings. Finally, and not together with the Supplemental Medicare Tax, self-used folks can deduct the employer part of self-employment taxes as an adjustment for AGI.

The Donut Hole

Payroll taxes are an essential piece of govt profits collection and are applied to fund federal insurance coverage plans these types of as Social Safety and Medicare. In point, in 2019, payroll taxes accounted for 38% of Interior Earnings collections next only to money taxes at 57%.

In recent decades there has been substantially concern pertaining to the solvency of these programs, primarily Social Stability. The 2020 Yearly Social Stability and Medicare Have faith in Fund Report estimates that entire gain payments can be paid out right up until 2034, when payments would decrease to 79% of rewards.

Social Stability has confronted solvency challenges in advance of, only to be afterwards solved by tax reforms. Most likely most noticeable were the 1983 amendments to the Social Security Act. Even so, reform can take many faces, and who it in the long run impacts relies upon on latest lawmakers and public notion.

Biden’s proposal for reform is reimposing the Social Stability tax on workers and self-employed folks earning more than $400,000, so generating a donut-hole outcome from $142,800 to $400,000 in earnings.

Medicare taxes, nevertheless, would continue being unchanged. Figures 1 and 2 exhibit the severity of these proposed adjustments. In equally eventualities, the taxpayers around experience a whopping 33% tax maximize!

Implications

It should really be observed that few taxpayers would be affected by the payroll tax raise since only 1.8% of households exceed $400,000 of full income. In addition, even if a household exceeds that range, there is possible a strong probability that some (or considerably) of that income is from other sources like passive or portfolio profits, which are not subject to payroll taxes.

And finally, Social Stability is a social insurance coverage system that is created to favor neither the prosperous nor very poor. This is around achieved in two methods.

1st, the Social Safety Administration takes advantage of actuarial calculations to help guarantee that cumulative retirement advantages are around equivalent to lifetime contributions irrespective of no matter if a recipient starts benefits early or late at reduced or improved levels, respectively.

A lot more exclusively, positive aspects are primarily based on an individual’s maximum 35 years of inflation-adjusted earnings. On the complete retirement age (FRA), which is either age 66 or 67 relying on birth calendar year, retirees can declare their whole unreduced advantages.

Conversely, retirees can assert added benefits as early as age 62, but with a 25% reduction, or claim as late as age 70 with a 24-32% enhance. This is crucial simply because wealthier retirees usually can afford to hold off Social Protection, as a result enjoying enhanced added benefits, whereas less rich retirees may need to have to claim early to complement retirement money wants and as a result encounter completely diminished rewards.

Next, in spite of Social Security taxes remaining regressive because of their preset proportion and taxable earnings ceiling, subsequent rewards are progressive simply because reduce earners receive increased alternative ratios on life span contributions.

In addition, in 2021 the greatest individual advantage at entire retirement age is $3,113 for each month, thus higher earners simply cannot receive outwardly disproportional positive aspects. Entirely, Social Security is extra impactful on a reduced earning personal in retirement.

What remains unclear, however, is if Biden’s proposal would consist of a secondary earnings limit and subsequently larger Social Safety positive aspects to enable offset the further upfront taxes. If not, higher earners slipping on the completely wrong aspect of the donut gap may now be confronted with what is primarily an outright tax, without having limitation, that acts as a subsidization tool for other Social Safety recipients.

Nonetheless even if there is a secondary earnings limitation and larger relevant positive aspects, greater earners may perhaps even now want to keep away from the taxes and as an alternative use the tax personal savings to fund other retirement or organization investments since of better perceived return probable.